Difference between revisions of "Cost of smokers"

Paul Herring (talk | contribs) |

Paul Herring (talk | contribs) |

||

| (6 intermediate revisions by the same user not shown) | |||

| Line 60: | Line 60: | ||

== Cost to the NHS == | == Cost to the NHS == | ||

Another claim is that smokers cost the NHS, and that they should pay extra for their habit. Ignoring the fact that they already do. | Another claim is that smokers cost the NHS, and that they should pay extra for their habit. Ignoring the fact that they already do. | ||

| + | |||

| + | === 2020/2020 from Nov 2020 === | ||

| + | * Flat excise duty of £244.78 per 1000 cigarettes.<ref>[https://www.gov.uk/government/publications/rates-and-allowances-excise-duty-tobacco-duty/excise-duty-tobacco-duty-rates Tobacco Products Duty rates, Updated 13 November 2020], GOV.UK [https://web.archive.org/web/20201209085821/https://www.gov.uk/government/publications/rates-and-allowances-excise-duty-tobacco-duty/excise-duty-tobacco-duty-rates archive.org]</ref> | ||

| + | * Excise rate of 16.50% | ||

| + | * Absolute minimum excise of £320.90 per 1000 cigarettes | ||

| + | * VAT rate of 20% | ||

| + | |||

| + | |||

| + | {| class="wikitable sortable" | ||

| + | | align="center" style="background:#f0f0f0;"|'''Inc VAT+Excise''' | ||

| + | | align="center" style="background:#f0f0f0;"|'''VAT''' | ||

| + | | align="center" style="background:#f0f0f0;"|'''Inc Excise alone''' | ||

| + | | align="center" style="background:#f0f0f0;"|'''%age excise''' | ||

| + | | align="center" style="background:#f0f0f0;"|'''Flat rate excise''' | ||

| + | | align="center" style="background:#f0f0f0;"|'''Total excise''' | ||

| + | | align="center" style="background:#f0f0f0;"|'''Actual excise''' | ||

| + | | align="center" style="background:#f0f0f0;"|'''Net''' | ||

| + | | align="center" style="background:#f0f0f0;"|'''Total Tax''' | ||

| + | | align="center" style="background:#f0f0f0;"|'''Tax %age of Cost''' | ||

| + | | align="center" style="background:#f0f0f0;"|'''Tax/Net''' | ||

| + | |- | ||

| + | | Formula||=A2-A2*(100/120)||=A2-B2||=C2*0.165||C2*£244.78/(1000/20)||=D2+E2||=max(F2,min)||=C2-G2||=B2+G8||=I2/A2||=I1/H2 | ||

| + | |- | ||

| + | | £8.00||£1.33||£6.67||£1.10||£4.90||£6.00||£6.42||£0.25||£7.75||96.89%||3117% | ||

| + | |- | ||

| + | | £8.50||£1.42||£7.08||£1.17||£4.90||£6.06||£6.42||£1.02||£7.48||88.01%||734% | ||

| + | |- | ||

| + | | £9.00||£1.50||£7.50||£1.24||£4.90||£6.13||£6.42||£1.37||£7.63||84.81%||558% | ||

| + | |- | ||

| + | | £9.50||£1.58||£7.92||£1.31||£4.90||£6.20||£6.42||£1.71||£7.79||81.95%||454% | ||

| + | |- | ||

| + | | £10.00||£1.67||£8.33||£1.38||£4.90||£6.27||£6.42||£2.06||£7.94||79.37%||385% | ||

| + | |- | ||

| + | | £11.00||£1.83||£9.17||£1.51||£4.90||£6.41||£6.42||£2.76||£8.24||74.92%||299% | ||

| + | |- | ||

| + | | £12.00||£2.00||£10.00||£1.65||£4.90||£6.55||£6.55||£3.45||£8.55||71.21%||247% | ||

| + | |- | ||

| + | | £13.00||£2.17||£10.83||£1.79||£4.90||£6.68||£6.68||£4.15||£8.85||68.08%||213% | ||

| + | |- | ||

| + | | £14.00||£2.33||£11.67||£1.93||£4.90||£6.82||£6.82||£4.85||£9.15||65.39%||189% | ||

| + | |- | ||

| + | | £15.00||£2.50||£12.50||£2.06||£4.90||£6.96||£6.96||£5.54||£9.46||63.05%||171% | ||

| + | |} | ||

=== 2017/2018 === | === 2017/2018 === | ||

| Line 65: | Line 108: | ||

* Excise rate of 16.50% | * Excise rate of 16.50% | ||

* VAT rate of 20% | * VAT rate of 20% | ||

| − | |||

| − | |||

{| class="wikitable sortable" | {| class="wikitable sortable" | ||

| Line 135: | Line 176: | ||

|} | |} | ||

| + | === From 6pm 27 October 2021 === | ||

| + | Excise on tobacco in the UK for will be<ref>[https://www.gov.uk/government/publications/rates-and-allowances-excise-duty-tobacco-duty/excise-duty-tobacco-duty-rates Tobacco Products Duty rates] - HMRC Oct '21 [https://archive.ph/wip/nYcYq archive.is]</ref> equal to 16.5% of the (pre-excise, pre-tax) retail price '''plus''' an equivalent £262.90 per 1,000 cigarettes (£5.258 per 20.) On top of this 20% VAT is charged. On a £9.75 packet of Pall Mall Shift Blue Kingsize from Tesco<ref>[https://archive.ph/Bax6T Archived Tesco website]</ref> for example, the net cost is £1.17, Excise £6.41, and VAT £1.63 for a total tax-take of £8.03 (82%): | ||

| + | |||

| + | {| class="wikitable sortable" | ||

| + | | align="center" style="background:#f0f0f0;"|'''Inc VAT+Excise''' | ||

| + | | align="center" style="background:#f0f0f0;"|'''VAT''' | ||

| + | | align="center" style="background:#f0f0f0;"|'''Inc Excise alone''' | ||

| + | | align="center" style="background:#f0f0f0;"|'''Excise''' | ||

| + | | align="center" style="background:#f0f0f0;"|'''Net''' | ||

| + | | align="center" style="background:#f0f0f0;"|'''Total Tax''' | ||

| + | | align="center" style="background:#f0f0f0;"|'''Tax %age of Cost''' | ||

| + | |- | ||

| + | | Formula||=A2-A2*(100/120)||=A2-B2||=5.258+(C2-C2*(100/116.5))||=C2-D2||=B2+D2||=F2/A2 | ||

| + | |- | ||

| + | | £9.75||£1.625||£8.125||£6.409||£1.716||£8.034||82% | ||

| + | |- | ||

| + | | £10.00||£1.667||£8.333||£6.438||£1.895||£8.105||81% | ||

| + | |- | ||

| + | | £10.50||£1.750||£8.750||£6.497||£2.253||£8.247||79% | ||

| + | |- | ||

| + | | £11.00||£1.833||£9.167||£6.556||£2.610||£8.390||76% | ||

| + | |- | ||

| + | | £12.00||£2.000||£10.000||£6.674||£3.326||£8.674||72% | ||

| + | |- | ||

| + | | £13.00||£2.167||£10.833||£6.792||£4.041||£8.959||69% | ||

| + | |- | ||

| + | | £14.00||£2.333||£11.667||£6.910||£4.756||£9.244||66% | ||

| + | |- | ||

| + | | £15.00||£2.500||£12.500||£7.028||£5.472||£9.528||64% | ||

| + | |} | ||

| + | |||

| + | === Income === | ||

Income for 2011/12 (the year prior to these figures) were £9.5bn from Excise and £2.6bn from VAT<ref>[http://www.the-tma.org.uk/tma-publications-research/facts-figures/tax-revenue-from-tobacco/ Tax revenue from tobacco] - Tobacco Manufacturers Association</ref> for a total of £12.1bn. Health care spending (including spending on the likes of [[Alcohol Concern]], [[ASH]], and homoeopathy<ref>[http://www.telegraph.co.uk/health/healthnews/8330749/Homeopathy-still-being-funded-on-NHS.html Homeopathy still being funded on NHS] - The Telegraph</ref>) was £121.3bn for 2011<ref>[http://www.ukpublicspending.co.uk/total_spending_2011UKbn Total Public Spending Expenditure 2011] - UK Public Spending</ref> | Income for 2011/12 (the year prior to these figures) were £9.5bn from Excise and £2.6bn from VAT<ref>[http://www.the-tma.org.uk/tma-publications-research/facts-figures/tax-revenue-from-tobacco/ Tax revenue from tobacco] - Tobacco Manufacturers Association</ref> for a total of £12.1bn. Health care spending (including spending on the likes of [[Alcohol Concern]], [[ASH]], and homoeopathy<ref>[http://www.telegraph.co.uk/health/healthnews/8330749/Homeopathy-still-being-funded-on-NHS.html Homeopathy still being funded on NHS] - The Telegraph</ref>) was £121.3bn for 2011<ref>[http://www.ukpublicspending.co.uk/total_spending_2011UKbn Total Public Spending Expenditure 2011] - UK Public Spending</ref> | ||

Latest revision as of 15:00, 16 June 2022

Much is made by anti-tobacco groups of the cost of smokers and smoking to the NHS (or the economy) in the UK, but such bland statements generally ignore various factors.

"Smoking breaks"

First is the claim that smoking breaks cost the economy millions, or even billions[1] while conveniently ignoring 'coffee breaks' that the non-smokers take.

The fact that breaks are needed/highly recommended in some jobs to remain productive seems to be ignored[2], as is the rather overwhelming fact that workers taking breaks (of any kind) is a matter between employer and employee, and as long as the work gets done, then there is no monetary cost:

Workers need breaks from their work in order to remain productive and on top of their work. Whether they take a fag break or a coffee break is irrelevant – and one cannot assume that people do not indulge in work activities or discussions while smoking a cigarette or over a cup of coffee or tea. It does not cost the economy – unlike expecting people to work without taking breaks. The question is; does the work get done, not how many minutes were taken out of the day on breaks recharging the mental batteries. And just how many cigarette related fires in the workplace have there been, precisely? This is barrel scraping to the extreme, frankly.[3]

Sick days

Also mentioned in the referenced Daily Mail article[1] is the claim that smokers have more sick days off than non-smokers, with reference to Weng, Ali & Leonardi-Bee (2012) - a piece of research with data of dubious provenance:

- if 3 non-smokers out of a workforce of 1000 have a sick day off, the implication to the research is that there will be about 4 smokers who have a day off. Or put another way, if sick days by smokers are costing business £1.1billion[1], then sick days by non-smokers are costing those same businesses a similar (but obviously smaller) amount - this amount is never mentioned, but from those numbers £0.83billion would be a decent estimate.

- the researchers cherry-picked their data - it was a meta-study of 29 studies, and of those they examined they used at most 17, and at least 8, to produce individual 'findings.'

Sickness in general

This figure includes [...] and £28.8million from smoking-related sick days. [4]

Sick days due to smoking related illnesses cost us £14.2m every year[5]

Largely bunkum as one commentator points out:

What's a smoking related sick day? Is it when you smoked too many fags the night before? I don't think so. The only thing I can think of that would be classed as a smoking related sick day would be long term absence due to multi factoral diseases that can be related to smoking. Employers tend to have sick pay schemes that are funded from the wage pot anyway. Some don't even pay sick pay. Employers make allowances for employees having time of work on the sick; you can't say that smoking related illnesses are costing them money.[6]

What smoking related illnesses cause time off work? If a person truly has a smoking related illness‡ that means they cannot work for a period of time it is generally a serious illness that would see them out of work permanently, usually in old age.

‡Smoking related. That's because many smoking related illnesses can't actually be pinned down to smoking and may have been the result of other factors. A smoking related illness is an illness that may have been caused by smoking.[7]

Littering

If every smoker stopped smoking tomorrow, would the ever decreasing number of bins (especially those with ashtrays in them) disappear completely?

Would thousands of people who clean the streets of litter suddenly find themselves unemployed?

Or would Blackburn and Darwin council/Kingdom Environmental Services be deprived of a further £617,000/yr of income?

I fired off an FOI request to B&D council and asked exactly what they had issued [£75] fines for in the last six months.

...

- Litter – black bag = 2

- Litter – cigarette = 4113

- Litter – food = 16

- Dog fouling = 26

- Litter – other = 110

- Litter – printed material = 9

- Smoke free = 151

...

If it was just about litter, if it was only about 'taking back the streets for law abiding citizens', why would Kingdom also be involved in enforcing smoking bans in indoor spaces and vehicles?[8]

Or £48,700/year (they get 15% of the fines, Kingdom keep the rest) in Flintshire

According to the report, a total of 4330 [of 4,726] of the [£75] fines handed out have been for people dropping cigarettes, with 296 other littering fines and 100 dog fouling fines dished out.[9]

Cost to the NHS

Another claim is that smokers cost the NHS, and that they should pay extra for their habit. Ignoring the fact that they already do.

2020/2020 from Nov 2020

- Flat excise duty of £244.78 per 1000 cigarettes.[10]

- Excise rate of 16.50%

- Absolute minimum excise of £320.90 per 1000 cigarettes

- VAT rate of 20%

| Inc VAT+Excise | VAT | Inc Excise alone | %age excise | Flat rate excise | Total excise | Actual excise | Net | Total Tax | Tax %age of Cost | Tax/Net |

| Formula | =A2-A2*(100/120) | =A2-B2 | =C2*0.165 | C2*£244.78/(1000/20) | =D2+E2 | =max(F2,min) | =C2-G2 | =B2+G8 | =I2/A2 | =I1/H2 |

| £8.00 | £1.33 | £6.67 | £1.10 | £4.90 | £6.00 | £6.42 | £0.25 | £7.75 | 96.89% | 3117% |

| £8.50 | £1.42 | £7.08 | £1.17 | £4.90 | £6.06 | £6.42 | £1.02 | £7.48 | 88.01% | 734% |

| £9.00 | £1.50 | £7.50 | £1.24 | £4.90 | £6.13 | £6.42 | £1.37 | £7.63 | 84.81% | 558% |

| £9.50 | £1.58 | £7.92 | £1.31 | £4.90 | £6.20 | £6.42 | £1.71 | £7.79 | 81.95% | 454% |

| £10.00 | £1.67 | £8.33 | £1.38 | £4.90 | £6.27 | £6.42 | £2.06 | £7.94 | 79.37% | 385% |

| £11.00 | £1.83 | £9.17 | £1.51 | £4.90 | £6.41 | £6.42 | £2.76 | £8.24 | 74.92% | 299% |

| £12.00 | £2.00 | £10.00 | £1.65 | £4.90 | £6.55 | £6.55 | £3.45 | £8.55 | 71.21% | 247% |

| £13.00 | £2.17 | £10.83 | £1.79 | £4.90 | £6.68 | £6.68 | £4.15 | £8.85 | 68.08% | 213% |

| £14.00 | £2.33 | £11.67 | £1.93 | £4.90 | £6.82 | £6.82 | £4.85 | £9.15 | 65.39% | 189% |

| £15.00 | £2.50 | £12.50 | £2.06 | £4.90 | £6.96 | £6.96 | £5.54 | £9.46 | 63.05% | 171% |

2017/2018

- Flat excise duty of £207.99 per 1000 cigarettes.

- Excise rate of 16.50%

- VAT rate of 20%

| Inc VAT+Excise | VAT | Inc Excise alone | %age excise | Flat rate excise | Net | Total Tax | Tax %age of Cost |

| Formula | =A2-A2*(100/120) | =A2-B2 | =C2*0.165 | C2*£207.99/(1000/20) | =C2-D2-E2 | =B2+D2+e2 | =F2/A2 |

| £6.00 | £1.00 | £5.00 | £0.83 | £4.16 | £0.02 | £5.98 | 99.75% |

| £6.50 | £1.08 | £5.42 | £0.89 | £4.16 | £0.36 | £6.14 | 94.41% |

| £7.00 | £1.17 | £5.83 | £0.96 | £4.16 | £0.71 | £6.29 | 89.84% |

| £7.50 | £1.25 | £6.25 | £1.03 | £4.16 | £1.06 | £6.44 | 85.88% |

| £8.00 | £1.33 | £6.67 | £1.10 | £4.16 | £1.41 | £6.59 | 82.41% |

| £8.50 | £1.42 | £7.08 | £1.17 | £4.16 | £1.75 | £6.75 | 79.36% |

| £9.00 | £1.50 | £7.50 | £1.24 | £4.16 | £2.10 | £6.90 | 76.64% |

2012/2013

Excise on tobacco in the UK for 2012 will be[11] equal to 16.5% of the (pre-excise, pre-tax) retail price plus an equivalent £167.41 per 1,000 cigarettes (£3.3482 per 20.) On top of this 20% VAT is charged. On a £7.50 packet of Marlboro for example, the net cost is £2.02, Excise £4.23 and VAT £1.25 for a total tax-take of £5.48 (73%):

| Inc VAT+Excise | VAT | Inc Excise alone | Excise | Net | Total Tax | Tax %age of Cost |

| Formula | =A2-A2*(100/120) | =A2-B2 | =3.3482+(C2-C2*(100/116.5)) | =C2-D2 | =B2+D2 | =F2/A2 |

| £5.50 | £0.917 | £4.583 | £3.997 | £0.586 | £4.914 | 89% |

| £5.75 | £0.958 | £4.792 | £4.027 | £0.765 | £4.985 | 87% |

| £6.00 | £1.000 | £5.000 | £4.056 | £0.944 | £5.056 | 84% |

| £6.25 | £1.042 | £5.208 | £4.086 | £1.122 | £5.128 | 82% |

| £6.50 | £1.083 | £5.417 | £4.115 | £1.301 | £5.199 | 80% |

| £6.75 | £1.125 | £5.625 | £4.145 | £1.480 | £5.270 | 78% |

| £7.00 | £1.167 | £5.833 | £4.174 | £1.659 | £5.341 | 76% |

| £7.25 | £1.208 | £6.042 | £4.204 | £1.838 | £5.412 | 75% |

| £7.50 | £1.250 | £6.250 | £4.233 | £2.017 | £5.483 | 73% |

| £7.75 | £1.292 | £6.458 | £4.263 | £2.195 | £5.555 | 72% |

| £8.00 | £1.333 | £6.667 | £4.292 | £2.374 | £5.626 | 70% |

From 6pm 27 October 2021

Excise on tobacco in the UK for will be[12] equal to 16.5% of the (pre-excise, pre-tax) retail price plus an equivalent £262.90 per 1,000 cigarettes (£5.258 per 20.) On top of this 20% VAT is charged. On a £9.75 packet of Pall Mall Shift Blue Kingsize from Tesco[13] for example, the net cost is £1.17, Excise £6.41, and VAT £1.63 for a total tax-take of £8.03 (82%):

| Inc VAT+Excise | VAT | Inc Excise alone | Excise | Net | Total Tax | Tax %age of Cost |

| Formula | =A2-A2*(100/120) | =A2-B2 | =5.258+(C2-C2*(100/116.5)) | =C2-D2 | =B2+D2 | =F2/A2 |

| £9.75 | £1.625 | £8.125 | £6.409 | £1.716 | £8.034 | 82% |

| £10.00 | £1.667 | £8.333 | £6.438 | £1.895 | £8.105 | 81% |

| £10.50 | £1.750 | £8.750 | £6.497 | £2.253 | £8.247 | 79% |

| £11.00 | £1.833 | £9.167 | £6.556 | £2.610 | £8.390 | 76% |

| £12.00 | £2.000 | £10.000 | £6.674 | £3.326 | £8.674 | 72% |

| £13.00 | £2.167 | £10.833 | £6.792 | £4.041 | £8.959 | 69% |

| £14.00 | £2.333 | £11.667 | £6.910 | £4.756 | £9.244 | 66% |

| £15.00 | £2.500 | £12.500 | £7.028 | £5.472 | £9.528 | 64% |

Income

Income for 2011/12 (the year prior to these figures) were £9.5bn from Excise and £2.6bn from VAT[14] for a total of £12.1bn. Health care spending (including spending on the likes of Alcohol Concern, ASH, and homoeopathy[15]) was £121.3bn for 2011[16]

In 2017 [17] excise was estimated to be £10.7bn and VAT £2.1bn for a total of £12.8bn.

Note that this implied 10% total funding of the NHS from tobacco, does not include the other tax extracted from smokers (in the manner it is extracted from non-smokers) in the form of VAT on all other products, excise on other products such as fuel etc. (I explicitly don't include excise from alcohol, since there are similar arguments to tobacco that can be made for that.)

Early death

Finally, there is the alleged cost to the 'tax-payer' in the form of old-aged smokers

- if people do have smoking related illnesses in old age, they are more likely to die earlier

- thus they will require less treatment

- additionally they will be drawing down less state retirement pension

However some anti-smoking rhetoric will put an early death as a detriment to the economy:

It estimates that £47.7million is lost in output due to early deaths caused by smoking and £8.5million due to early deaths caused by passive smoking.[4]

The output lost from early deaths is £23.3m a year[5]

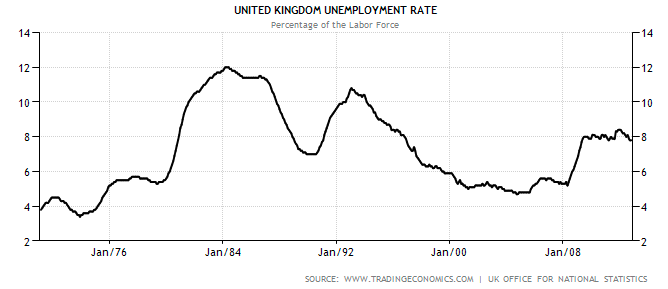

Patent nonsense - unemployment in the UK has never been below 3% since 1971 and never been below 5% since 1975. Anyone leaving the workforce due to any reason is likely to be replaced with one of the unemployed:

This also ignores the fact that we do not have a duty to live as long as we can to be sponged off by the state/contribute to the economy. Any commentator coming up with a "lost" money figure is being necessarily speculative, and likely presumes that any (ex-)smoker dying "earlier" than actuarial life tables suggest has died primarily because of smoking.

Additionally Policy Exchange released Nash & Featherstone 2010 which stated:

[...]smoking remains the single largest cause of preventable mortality - over 83,000 deaths in England in 20083[...]

[...]

[...]and also the [annual] loss in economic output from the deaths of smokers (£4.1 billion) and passive smokers (£713 million).

[...]

3NHS Information Centre. Statistics on Smoking in England. 2009.[19]

£4.813 billion divided by 83,000 people is £57,987.95. I rather suspect that your average person who's died from "smoking related disease/illness" would not - had they lived - have contributed £58,000 per annum to the economy had they not died. Or more pertinently not smoked.

Median gross wage (for men, in full-time work, in London) in 2010 was £33,852[20]. Average gross pension income was £23,192[21]

They also, no doubt, don't bother including the other side of the fence: the people who are (ex-)smokers who live longer such as Jeanne Calment (died 122) who smoked most of her life[22], Buster Martin (died 104, but exact age disputed) who smoked from the age of seven[23] until his death.

References

- ↑ a b c Smokers cost businesses £2.1bn a year due to 'fag breaks' and sickness - The Daily Mail

- ↑ Working in comfort – Taking breaks and varying your tasks - Hewlett Packard

- ↑ More Smoking “Research” - Longrider

- ↑ a b Cost of smoking to East Lancashire's economy calculated as £163million - Lancashire Telegraph

- ↑ a b Smoking costs Plymouth £78.2million a year - This is Plymouth

- ↑ 163 million? Let's have a fag and take a closer look. - The Moose

- ↑ - More 'cost of smoking' bollocks - It's all bollocks

- ↑ Kingdom - Another Attack on Smokers? - The Moose blog

- ↑ <Litter fine company catches almost 5,000 people in Flintshire - Daily Post

- ↑ Tobacco Products Duty rates, Updated 13 November 2020, GOV.UK archive.org

- ↑ Tobacco Products Duty Rates - HMRC

- ↑ Tobacco Products Duty rates - HMRC Oct '21 archive.is

- ↑ Archived Tesco website

- ↑ Tax revenue from tobacco - Tobacco Manufacturers Association

- ↑ Homeopathy still being funded on NHS - The Telegraph

- ↑ Total Public Spending Expenditure 2011 - UK Public Spending

- ↑ Smoking and the Public Purse - iea

- ↑ United Kingdom Unemployment Rate - Trading Economics

- ↑ Cough up: Nash & Featherstone 2010

- ↑ 2011 Annual Survey of Hours and Earnings (SOC 2000) - Office for National Statistics

- ↑ Pensioners’ Incomes Series 2010-11 - Department for Work and Pensions; page 20

- ↑ How to live to 100... beer, fags and red meat - The Sun

- ↑ The strange tale of Buster Martin - The Guardian